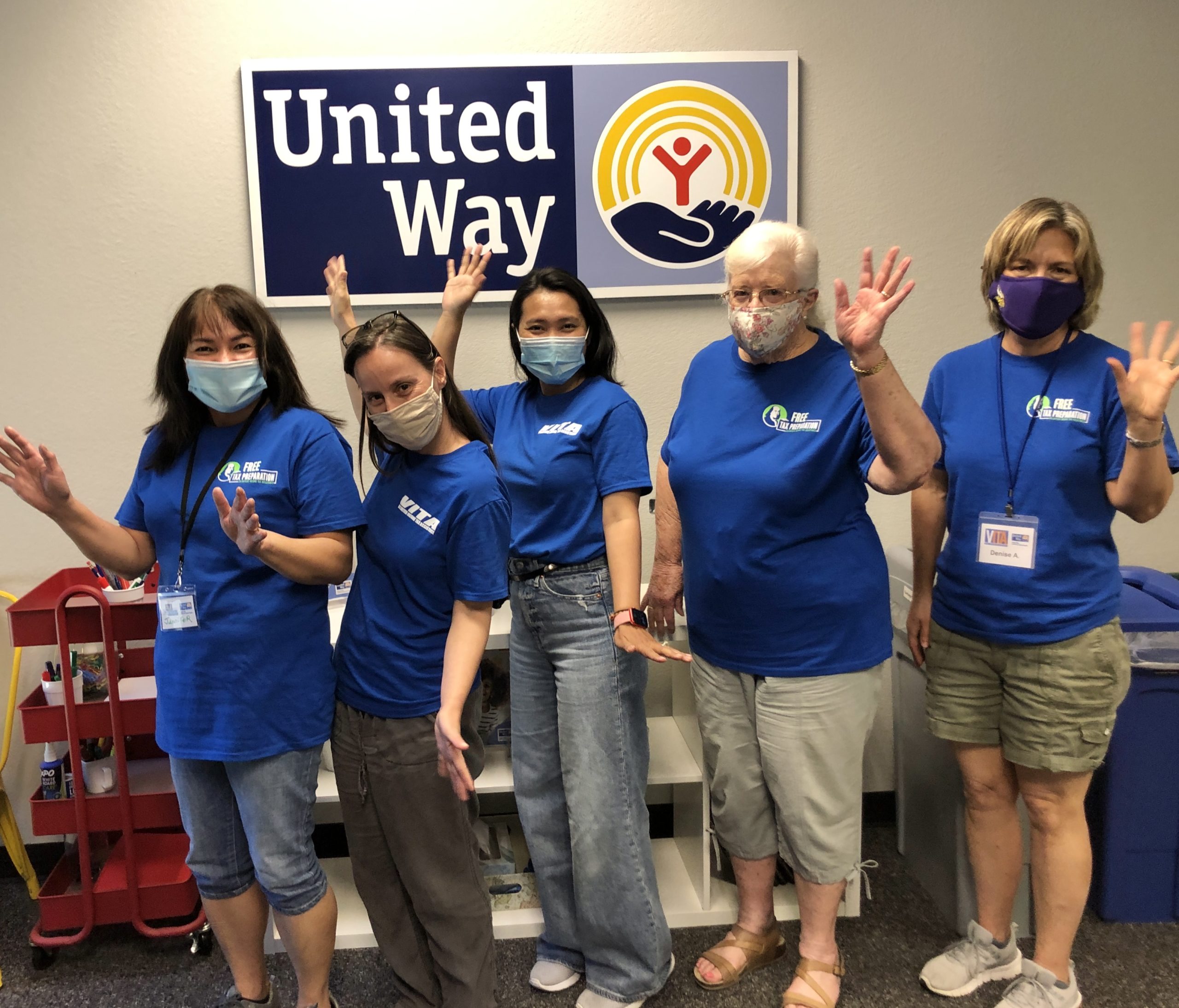

Volunteers are needed to help families across the region file their taxes and apply for tax credits as part of United Way California Capital Region’s Free Tax Prep program. No experience is needed, as participants receive training to become IRS-certified volunteers. The training includes five full-day sessions and an open-book test at the end of training for certification. Volunteers must be signed up by end of November. Tax preparation certification training begins Nov. 5. For more information or to sign up to volunteer: YourLocalUnitedWayFreeTaxPrep.org.

“Our Free Tax Prep volunteers play a big role in ensuring local families receive help applying for the maximum tax benefits for which they are eligible,” said Dr. Dawnté Early, president and CEO, United Way California Capital Region. “Many families in our region have earned these tax credits, but do not know they are eligible. These are important funds they can use to meet immediate needs and increase their household’s financial stability.”

Each year, United Way and hundreds of volunteers help families and individuals earning less than $66,000 annually file their taxes for free. Last tax season, our Free Tax Prep program helped more than 4,000 families receive more than $9.5 million in tax refunds, including CalEITC.

United Way California Capital Region has been working to fight poverty for nearly 100 years by creating stronger, healthier, more compassionate communities, now serving Amador, El Dorado, Placer, Sacramento and Yolo counties. The local United Way has found one place in each community to reach the most families in need: School is square one for ending family poverty. United Way uses its Square One approach to end poverty for local families by helping children excel in school, investing in families, and strengthening schools with resources to address increased poverty and deep roots of racial inequality. To learn more and make a donation: YourLocalUnitedWay.org.